A mortgage calculator assists you in estimating monthly payments with property taxes, PMI, principal and interest components, HOA fees, and home insurance. It also helps in many other tasks such as calculating PITI amount, and HOA fees during the entire amortization period.

People use mortgage calculators for a variety of tasks. Firstly, you can use it to calculate the maximum home purchase price provided by your annual household price. Secondly, you can use it to calculate the monthly mortgage payment of a home, utilizing home purchase price and current mortgage rates.

Besides, it can also help determine the maximum home purchase price, provided your monthly budget for housing.

Keep reading the article, and we will describe the mathematical ways to calculate mortgages using the accounting formula. Additionally, we will also tell you how to use a mortgage calculator and all the terms involved in it.

Contents

Mathematical calculations

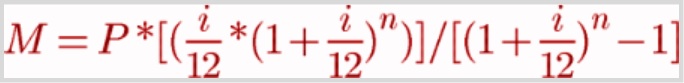

The Mathematical formula for mortgage calculation is:

Where:

- M = Monthly payment, you have to pay

- P = Principal Amount (amount of loan issued)

- i = interest rate

- n = number of monthly payments for the mortgage. For example, if you want a 10-year mortgage loan, then n will be 120 (12 * 10).

How to use a mortgage calculator?

If you want to calculate how much payment you will pay monthly for a mortgage each month using a mortgage calculator, you have to put four things in the calculator:

Home price

It is the amount at which you can purchase a home. To calculate this, you should not include closing costs and loan fees. In simple words, it is the contractually agreed price of your home.

Mortgage interest rate

It is the rate that the mortgage lender or bank provides you to repay your mortgage every year. These rates are usually given in annual terms and mostly remain unchanged for the life of a loan that we will discuss in detail later in the loan type section.

However, the interest rate can change after several years. While calculating the monthly payments, you should always use the interest rate of the current year.

Down payment

It is the amount of equity; you pay at the time of purchase. For example, if you buy a house for $300,000 and pay $15,000 initially, your down payment is 5%. Different mortgage lenders require you different down payments.

Loan type

Here, you will get three options: 30 years fixed loan, 15 years fixed loan, and 5/1 ARM. First, two are fixed loan types, and the interest rate remains constant in the entire loan span. However, ARM is adjustable, and loan rates vary from time to time in this scheme.

Paying your mortgage insurance

A mortgage calculator also helps you calculate several other terms such as mortgage insurance (PMI).

If you get a home loan with less than 20% down payments, you have to pay for PMI. It usually ranges from 0.58% to 1.86% of the loan amount.

For calculating the PMI in the mortgage calculator, you have to fulfill the following box: home price, down payment, interest rate, loan scheme, and mortgage insurance rate; and the calculator will provide you monthly PMI for the house.

Bottom line

A mortgage calculator is beneficial to calculate different things related to your homes, such as mortgage payment of a house, maximum home purchase price, and mortgage insurance (PMI).

In this article, we have discussed the mathematical formula for a mortgage calculator. Besides, we have also discussed how to use it and its different components that you can check above in the article.

Writer and content creator interested in Entrepreneurship, Marketing, Jobs and landlord issues. I have a bachelor’s degree in Communication from the Andrés Bello Catholic University, VE, and I also studied at Chatham University, USA. In this blog I write and collect information of interest around agreements, property and mortgage.